There are over forty rating factors that affect the cost of your car insurance but only a handful have a significant impact. One of these is the insurance group rating of your car. So, what is the insurance group and why does it matter?

What are insurance groups?

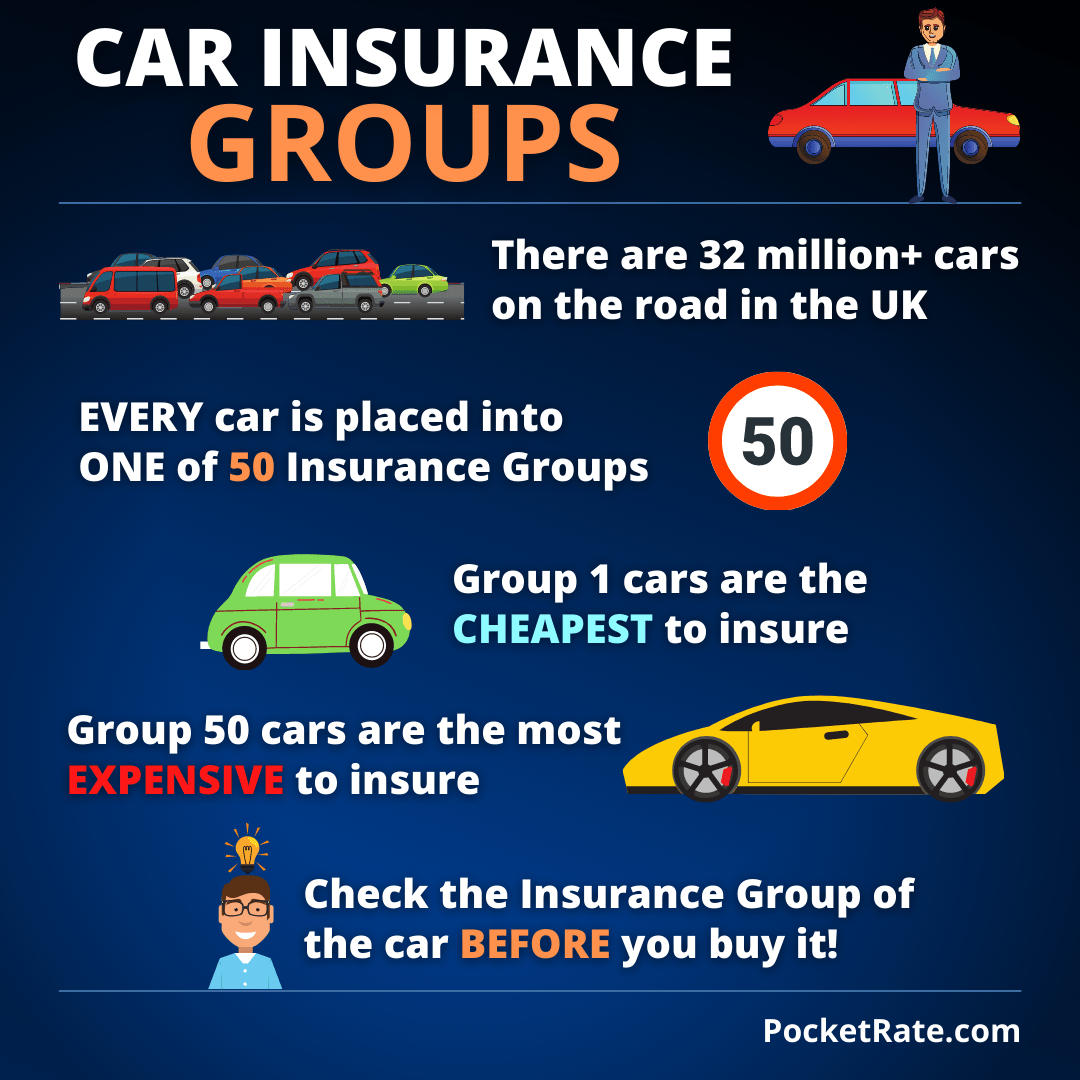

According to the RAC Foundation there were around 32 million cars on the road in Great Britain at the end of March 2021 which is approximately 82.1% of all vehicles.

It would be virtually impossible for insurance underwriters to individually maintain a rate for each car. Instead, they group every car into one of 50 insurance groups, with each group assigned a specific weighting for use in the quote calculation.

Insurance groups are arranged in order of lowest to highest risk. Group 1 cars are classed as the lowest risk and are therefore the cheapest to insure, whereas group 50 are considered high risk cars and are the most expensive to insure.

It follows that in order to keep your premium low, you should opt to buy as low an insurance group rated car as possible, preferably a group 1 car. This is particularly important if you are a new or young driver where insurance costs are already high.

How are insurance group numbers decided?

In allocating a group number, underwriters have to consider a number of factors regarding the car make and model including:

1. The value of the car

How much your car is worth is an obvious consideration given that the insurer may have to compensate you for a vehicle write-off in the event of an accident. The more a car costs, the heavier the weighting applied by insurers and in turn the higher the insurance group rating.

However, it’s worth noting that depending on the policy terms, some insurers will replace your car with an equivalent make and model in terms of the age and mileage. Other companies though may have a standard policy that provides a new for old car. It’s definitely worth checking the policy wording to see what your insurer offers.

2. Engine size and performance

Cars with larger engine sizes will generally produce more power resulting in higher acceleration and faster speeds (however, with modern technology this is not always the case). Therefore, the larger the engine size the more likely it will be assigned a higher insurance group.

3. Cost of replacement parts

Most accidents are relatively minor and often just need your car to be repaired. The availability and cost of finding replacement parts for your car is important to underwriters.

A mass-produced car such as the Ford Fiesta will have spare parts readily available and at low cost. However, sourcing parts for higher spec cars may prove difficult and expensive which adds to the overall claim cost incurred by the insurer.

Easy to find and cheaper replacement parts result in a lower group rating whereas made to order parts for unusual or expensive models will attract a higher group rating.

4. Repair time costs

A significant chunk of claim costs is paid towards repairing cars. The availability and length of time it takes to repair certain models may have an adverse effect on the insurance group rating. Cars that are straightforward to repair and have lower labour costs attract a lower weighting than cars which are hard to repair and require longer times to fix.

Safety features

The biggest risk for any insurer is the liability it has for personal injury. Such claims can run into millions of pounds and so anything that can reduce that risk in an accident is perceived as a positive by underwriters.

Top 10 car safety features:

- Airbags

- Autonomous Emergency Braking (AEB)

- Lane Assist

- Electronic Stability Control (ESC)

- Adaptative Cruise Control (ACC)

- Blind Spot Detection

- Reverse Parking Assistant

- Reverse Parking Camera

- Adaptive Headlights

- Tyre Pressure Monitor

The improvements in car safety can often mean that a newer, more expensive model attracts a lower insurance group than the older, equivalent model that has less safety technology. This is because the newer model is seen to prevent more personal injury claims than the higher risk earlier model.

Car security features

The more standard built-in security a car has, the better the risk and the lower the insurance group weighting including:

- Car alarms

- Immobilisers

- Key fob security

- Security lights,

- Car door defenders

- Thatcham trackers

- Steering wheel locks

You can of course add your own security to your car after buying it. This in itself will not lower the insurance group (that is fixed), however, you can contact your insurer to inform them that you've added these features and it will often attract a reduction in your cost.

Insurance group and young driver age combination

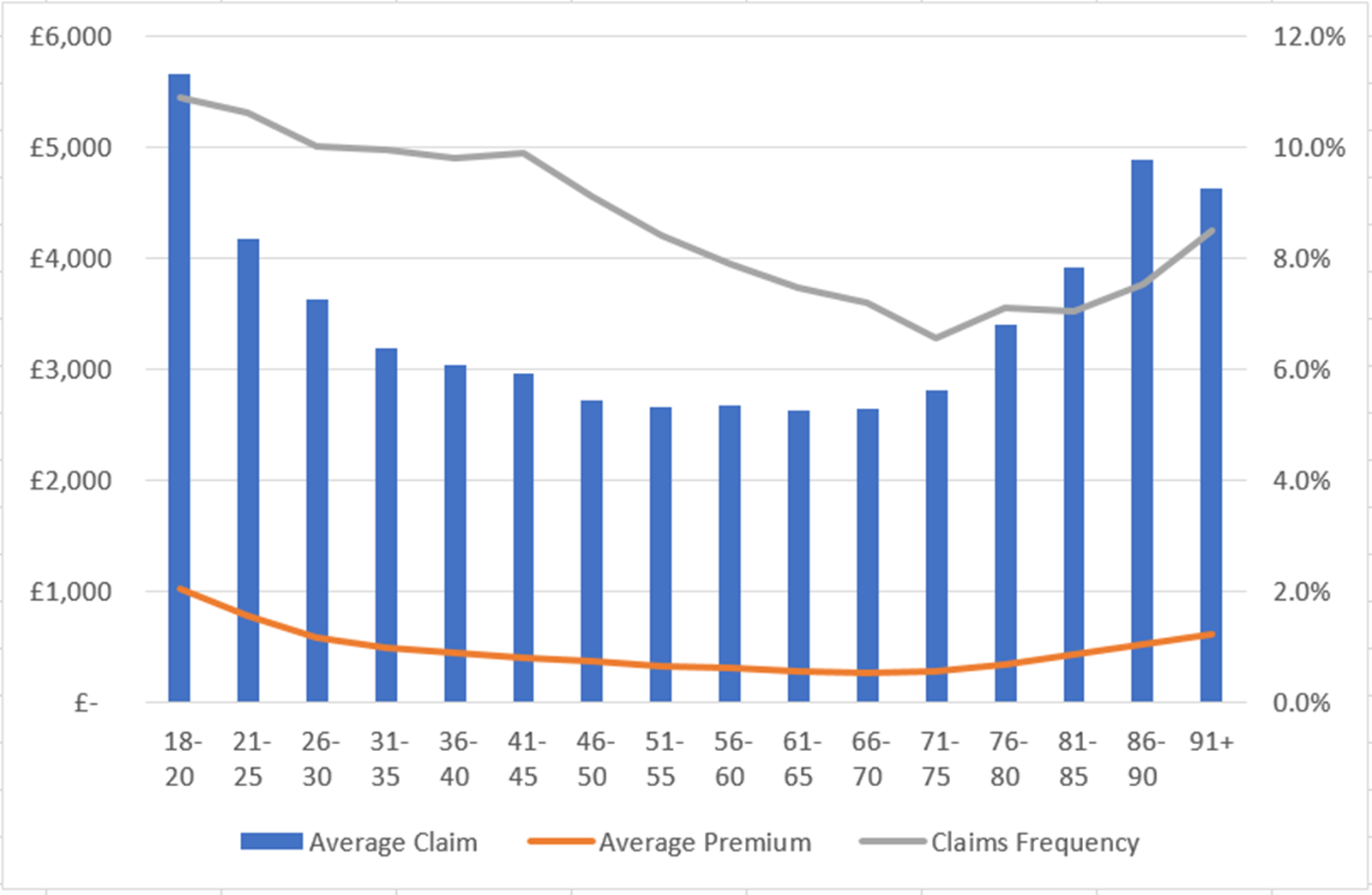

As part of the underwriting process, insurance companies also look at the combination effect of the insurance group rating together with the age of the driver.

The accident statistics for young drivers in particular are poor and this is due to a lack of experience behind the wheel, driving too fast and too erratic. Claim frequency (the amount of times people claim) and claim costs are the highest for this demographic.

The more powerful a car is, the faster it can accelerate and the higher the risk of having an accident. A smaller engine car will accelerate at a moderate pace and help prevent high speed crashes or losing control of the vehicle.

It stands to reason therefore that the combination of a young driver and a high group car increases the risk exponentially. It’s why many insurers may not even offer a quote to young drivers for high group cars. Where quotes are given, you often find they can run into thousands or even tens of thousands.

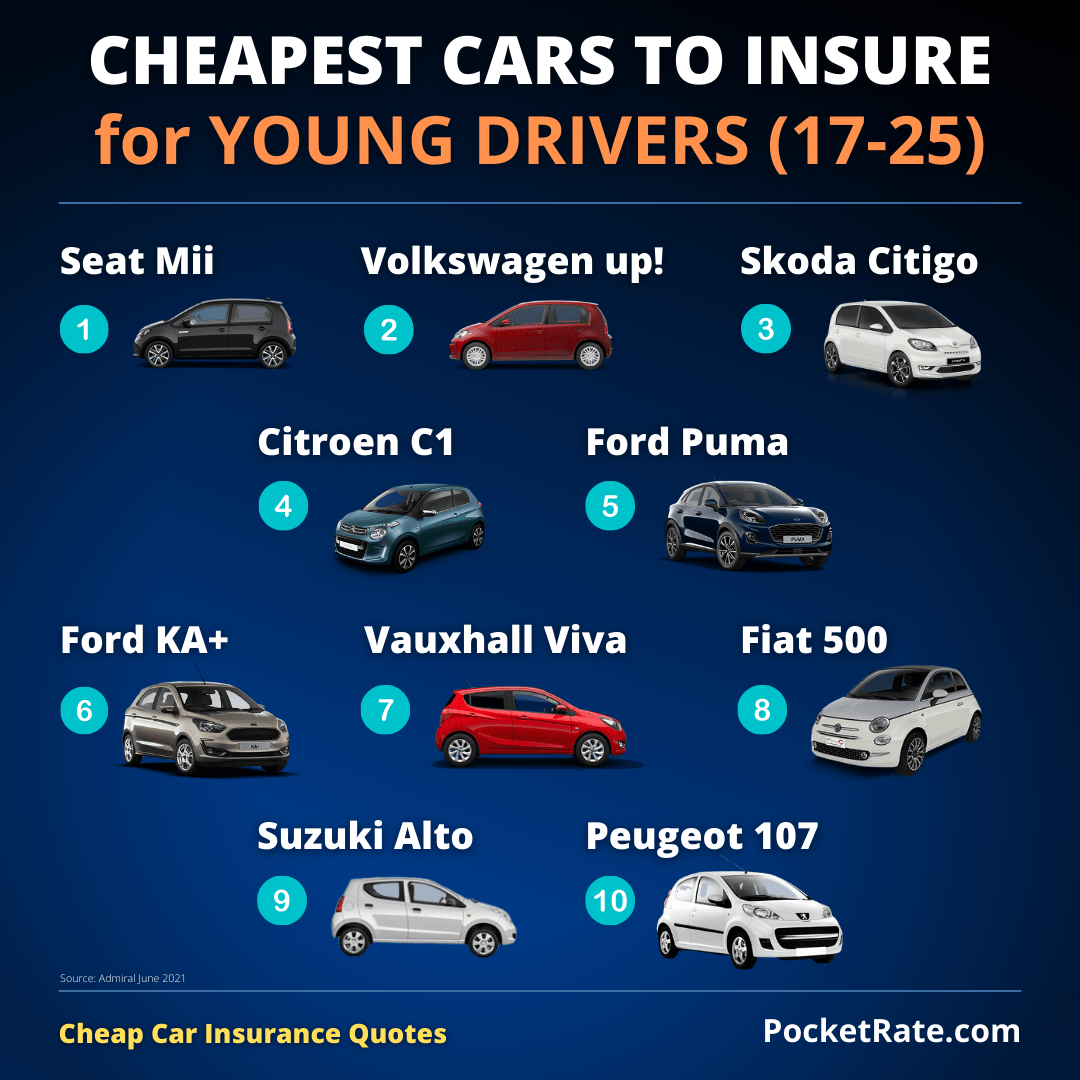

This is why young drivers should always consider buying an insurance group 1 car or as low as possible. A group 1 car won’t attract a high group/driver age rating and it will certainly help keep your overall quote lower.

Group 1 rated cars may not seem the most desirable to young drivers but it’s only for a relatively short time in order for you to gain experience. The game here is to keep your initial insurance costs as low as possible, build up your No Claims Bonus (NCB) and then opt for a higher group car.

Just one or two years of NCB can get you 25%-30% discount on your insurance. Five years or more NCB can reward you with a whopping 75% discount with some companies. So, it pays to start with a low group car, drive safely, stay claim free, be patient and watch your premiums come tumbling down. Only then should you opt for a higher group car as your NCB will automatically bring down the inevitable higher cost for that higher rated vehicle.

*Example: No Claims Discount table:

| NCD Years | Discount |

| 0 | 0% |

| 1 | 25% |

| 2 | 35% |

| 3 | 50% |

| 4 | 60% |

| 5 | 75% |

*for illustration purposes only

Check the insurance group before buying a car

It’s easy to get caught up in the excitement of buying a new car but you should always check the following:

1. You can actually get insurance for the car

There are many cases where people have committed to buying a car only to find that nobody will insure them. Often this is because the insurance group and driver age combination are too much of a risk for an insurer to accept.

2. You can afford the cost of the insurance

Even if you can get companies to offer you a quote for a high group car, you need to ensure that your budget enables you to pay for it. The cost of running a car is high, with one comparison site estimating an average cost of over £6k just to get on the road in your first year including an average insurance premium of over £1,700.

3. Shop around for the cheapest insurance

Don’t just accept the first quote you’re offered. The market for car insurance is big and the competition is high. Always use at least one comparison site as some sites may have providers and custom insurance schemes that other do not or they may have negotiated unique rates for certain products.