Table Summary of Modifications & Costs

| Modification Type | Impact on Premiums | Reason |

|---|---|---|

| Engine Upgrades | Increase by 80-100% | Significantly increases speed and performance, leading to higher risk of accidents and costly repairs. |

| Turbo/Superchargers | Increase by 130-150% | Significantly boosts power, associated with high-risk driving behaviour. |

| Custom Paint Jobs | Increase by 30-40% | Makes the car more attractive to thieves, increasing theft risk. |

| Alloy Wheels | Increase by 5-15% | Higher value and attractiveness to thieves. |

| Suspension Modifications | Increase by 25-50% | Improves handling but can affect safety on uneven roads. |

| Braking System Upgrades | Increase by 35-50% | Indicates potential for high-speed driving, increasing risk. |

| Body Kits | Increase by 50-75% | Increases the car’s value and risk of damage in accidents. |

| Window Tinting | Increase by 15-20% | Affects visibility; heavy tints may not be legal. |

| Sound Systems | Increase by 10-15% | Increases car’s value and theft risk. |

| Tow Bars | Neutral | Seen as practical, often does not affect premiums. |

| Sway Bars | Decrease by 5-10% | Improves handling, reducing body roll and potential accidents. |

| Interior Modifications | Increase by 25-30% | Increases car’s value, potential for high-risk driving behaviour. |

| Cold Air Intake | Increase by 5-10% | Improves performance slightly, but also raises the car's value. |

| Exhaust System Modifications | Increase by 5-10% | Enhances performance, but increases noise and may not be legal. |

| Nitrous Oxide Systems | Increase by 130-150% | Increases performance significantly, considered high-risk and potentially dangerous. |

| Roll Cages | Increase by 40-50% | Enhances safety in rollovers but indicates high-risk driving behaviour. |

| Wheel Arches | Increase by 20-25% | Allows for larger tyres, increasing performance and risk. |

| Custom Lights | Increase by 10-15% | Improves visibility but can be illegal and distracting. |

| Additional Security Systems | Decrease by 5-10% | Reduces theft risk, making the car safer (e.g., trackers, alarms, immobilizers). |

| Rear Spoilers | Increase by 10-20% | Improves aerodynamics but associated with high-speed driving and risk-taking behaviour. |

| Performance Tyres | Increase by 5-10% | Increases handling and performance, suggesting higher-risk driving. |

| Lowered Suspension | Increase by 25-50% | Enhances handling and performance but can affect safety on uneven roads. |

| Custom Exhaust Tips | Increase by 5-10% | Enhances appearance and may increase noise levels, suggesting performance modifications. |

| Sunroofs/Moonroofs | Increase by 5-10% | Adds value and increases potential for water damage and theft entry points. |

| Body Decals and Wraps | Increase by 5-10% | Makes the car more distinctive, increasing theft risk. |

| Modified Gearbox | Increase by 10-15% | Enhances performance, suggesting higher-risk driving behaviour. |

| Custom Steering Wheels | Increase by 5-10% | Can affect control and suggest high-performance modifications. |

| LPG Conversion | Neutral to Decrease by 5% | Can reduce fuel costs and emissions, seen as an eco-friendly improvement. |

Disclaimer: The data and insights in this table are derived from our own research efforts and knowledge. While we strive for accuracy, please consult authoritative sources for verification before making any decisions based on this information. Always confirm details with your current and/or prospective insurance provider.

Modifications explained

Engine Upgrades

- What is it: Enhancing the engine to improve power and performance.

- How it's fitted: Typically involves changing internal engine parts or adding new components like high-performance air filters. These modifications usually require a skilled mechanic or a specialized performance shop to ensure proper installation and calibration.

- Underwriter view: Insurers view engine upgrades as high-risk because they significantly increase the vehicle's speed and performance. This enhanced performance can lead to a higher likelihood of accidents due to the increased temptation to drive at higher speeds and the added strain on engine components.

- Impact on premiums: Increases by 80-100% due to the higher risk of accidents and costly repairs. The increased speed and performance can result in more severe accidents, leading to higher claims.

Turbo/Superchargers

- What is it: Devices that force more air into the engine, significantly boosting power.

- How it's fitted: Turbochargers or superchargers are installed onto the engine to increase the amount of air and fuel that can be combusted, resulting in more power. This installation often requires modifying the intake and exhaust systems and sometimes even the engine's internal components to handle the increased power.

- Underwriter view: Turbochargers and superchargers are associated with very high-risk due to the substantial power increase they provide. This can encourage more aggressive driving and higher speeds, both of which increase the risk of accidents.

- Impact on premiums: Increases by 130-150% as these modifications are linked with high-risk driving behaviour and significantly increase the car's power output.

Custom Paint Jobs

- What is it: Unique paint schemes that make a car stand out.

- How it's fitted: Custom paint jobs involve professionally repainting the car with unique colours, designs, or patterns. This process can include airbrushing, custom graphics, and specialty finishes like metallic or pearlescent paint.

- Underwriter view: Insurers see custom paint jobs as increasing the car's attractiveness to thieves. A distinctively painted car is more noticeable and often indicates higher overall value.

- Impact on premiums: Increases by 30-40% because it makes the car more attractive to thieves, increasing the risk of theft and vandalism.

Alloy Wheels

- What is it: Lightweight metal wheels that improve handling and appearance.

- How it's fitted: Alloy wheels replace the car’s original steel wheels. They are bolted onto the car using the existing lug nuts or bolts.

- Underwriter view: Alloy wheels are considered high-value items that enhance the car's attractiveness. This increases the risk of theft, as thieves target vehicles with high-value components.

- Impact on premiums: Increases by 5-15% due to the higher theft risk associated with the added value and appeal of alloy wheels.

Suspension Modifications

- What is it: Changes to the car’s suspension to improve handling.

- How it's fitted: Suspension modifications can involve replacing the car's springs, shocks, or even the entire suspension system with performance-oriented components. This is typically done to improve the vehicle's handling and stability, particularly in high-speed or performance driving scenarios.

- Underwriter view: While improved handling can be beneficial, these modifications can also reduce safety on uneven or rough roads. Insurers are concerned about the potential for increased wear and tear on the vehicle and the likelihood of aggressive driving.

- Impact on premiums: Increases by 25-50% as it affects the car's handling dynamics, potentially leading to increased accident risk on uneven roads.

Braking System Upgrades

- What is it: Enhanced brakes for better stopping power.

- How it's fitted: Upgrading the braking system involves installing larger brake discs, high-performance brake pads, and sometimes even replacing the entire braking system with a more advanced setup. This requires professional installation to ensure the braking system operates correctly and safely.

- Underwriter view: Enhanced brakes indicate that the car is likely to be driven at higher speeds, which increases the risk of high-speed accidents. Insurers associate these modifications with high-risk driving behaviour.

- Impact on premiums: Increases by 35-50% due to the increased risk associated with high-speed driving and the potential for more severe accidents.

Body Kits

- What is it: Additional panels and parts that change the car's exterior look.

- How it's fitted: Body kits include front and rear bumpers, side skirts, and sometimes spoilers and hood scoops. These components are typically bolted or bonded to the car’s existing body panels.

- Underwriter view: Body kits increase the car's value and make it more susceptible to damage in minor collisions. They also increase the risk of theft, as modified cars are often more attractive to thieves.

- Impact on premiums: Increases by 50-75% as body kits can be damaged more easily and increase the car's overall value and attractiveness to thieves.

Window Tinting

- What is it: Darkening of windows to reduce glare and improve privacy.

- How it's fitted: Window tinting involves applying a tint film to the car's windows. This film can vary in darkness and is applied on the interior side of the windows.

- Underwriter view: While tinting can provide benefits like reduced glare and improved privacy, it can also affect visibility, particularly at night. Additionally, heavy tints may not be legal in all regions, leading to potential legal issues.

- Impact on premiums: Increases by 15-20% because of visibility concerns and potential legal issues. Insurers consider these factors when calculating risk.

Sound Systems

- What is it: High-performance audio systems.

- How it's fitted: Installing aftermarket speakers, subwoofers, amplifiers, and head units to replace or enhance the factory audio system. This often involves rewiring and mounting the new components in custom enclosures.

- Underwriter view: High-performance sound systems increase the car’s value and attractiveness to thieves. The risk of theft is higher as these systems are often sought after by criminals.

- Impact on premiums: Increases by 10-15% due to the higher theft risk associated with valuable audio equipment.

Tow Bars

- What is it: Bars attached to the car to enable towing.

- How it's fitted: Tow bars are mounted to the rear chassis of the car. They can be detachable or fixed and require precise installation to ensure they are safe and functional.

- Underwriter view: Generally seen as a practical modification, tow bars are often associated with safe, utility-based usage rather than performance driving.

- Impact on premiums: Neutral as it often does not affect premiums. Tow bars are typically seen as practical additions that do not significantly alter the car's risk profile.

Sway Bars

- What is it: Bars that reduce body roll during cornering.

- How it's fitted: Sway bars (or anti-roll bars) are installed between the suspension components of the car to improve handling by reducing body roll during cornering. They are typically bolted to the car’s chassis and suspension arms.

- Underwriter view: Sway bars improve the car's handling and stability, reducing the likelihood of rollovers and accidents due to loss of control.

- Impact on premiums: Decreases by 5-10% as they enhance handling and reduce the risk of accidents, making the vehicle safer to drive.

Interior Modifications

- What is it: Custom changes to the car’s interior, such as new seats or dashboards.

- How it's fitted: Involves replacing or altering interior components like seats, dashboard panels, and upholstery. These modifications can range from aesthetic changes to functional upgrades like racing seats or custom gauge clusters.

- Underwriter view: Interior modifications can increase the car's value and potential for high-risk driving behaviour, particularly if the modifications are performance-oriented.

- Impact on premiums: Increases by 25-30% as they enhance the car's value and may indicate a higher likelihood of risky driving behaviour.

Cold Air Intake

- What is it: Enhances engine performance by bringing in cooler air.

- How it's fitted: A cold air intake system replaces the factory air intake with a system designed to draw cooler air from outside the engine compartment. This often involves installing a new intake pipe and filter.

- Underwriter view: Improves engine performance slightly but also increases the car's value. While the performance boost is minor, it can still contribute to a higher perceived risk.

- Impact on premiums: Increases by 5-10% due to the slight performance enhancement and increase in the vehicle's value.

Exhaust System Modifications

- What is it: Changes to the exhaust to improve performance and sound.

- How it's fitted: Modifying the exhaust system can involve replacing the muffler, adding a performance exhaust, or installing a full exhaust system. This can improve exhaust flow and enhance the engine's performance and sound.

- Underwriter view: Enhanced exhaust systems increase performance and noise levels, which can be seen as indicators of high-risk driving behaviour.

- Impact on premiums: Increases by 5-10% because of the increased performance and noise, which can lead to higher risk driving.

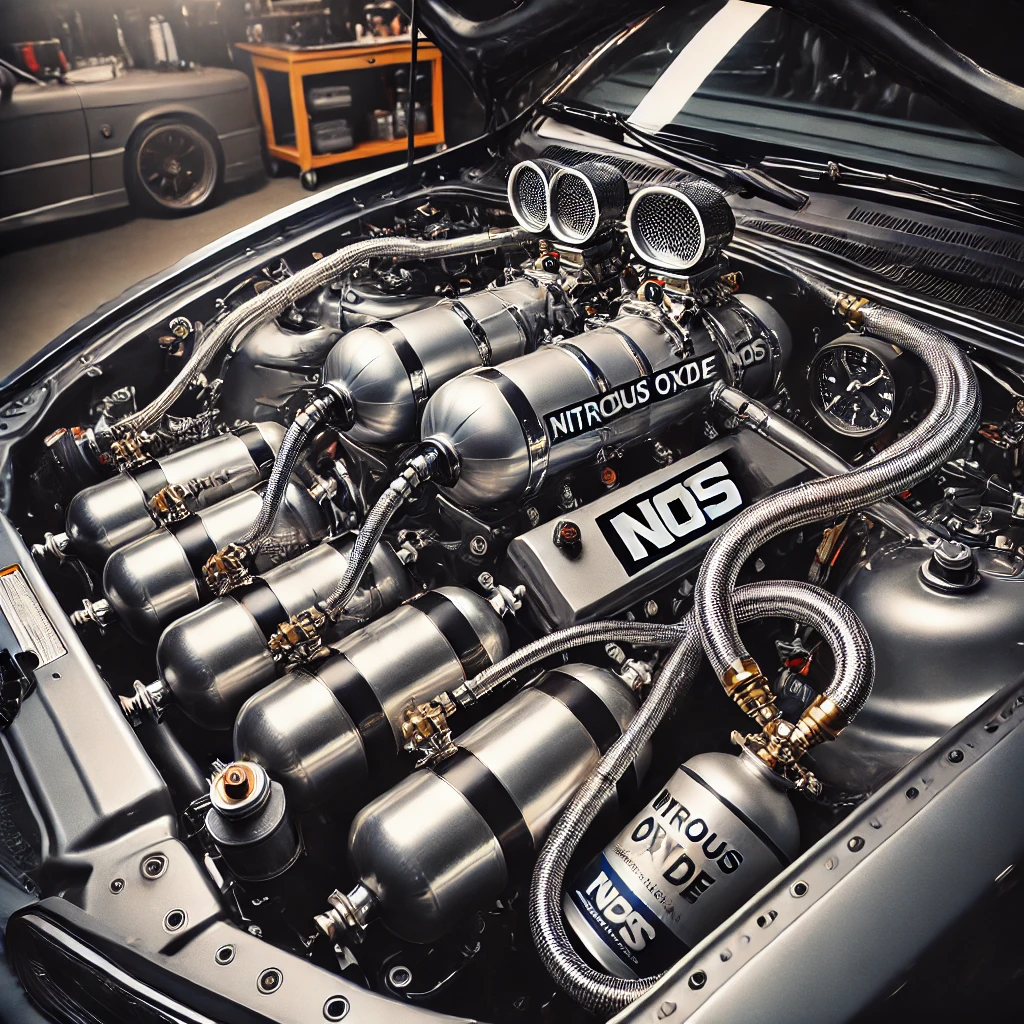

Nitrous Oxide Systems

- What is it: Adds significant power boost by injecting nitrous oxide into the engine.

- How it's fitted: Nitrous oxide systems are installed with a nitrous kit that includes a bottle, lines, and injectors to deliver the gas into the engine. This requires precise installation and tuning to ensure safe operation.

- Underwriter view: Considered very high-risk due to the significant and sudden power increase, which can be dangerous if not used properly.

- Impact on premiums: Increases by 130-150% as it’s considered highly dangerous and significantly boosts the vehicle's performance.

Roll Cages

- What is it: Metal frameworks inside the car to protect occupants in a rollover.

- How it's fitted: Roll cages are welded or bolted inside the car’s interior, often around the passenger compartment. They are designed to provide structural integrity in case of a rollover.

- Underwriter view: While roll cages improve safety in rollovers, they are often associated with high-risk driving behaviours such as racing.

- Impact on premiums: Increases by 40-50% due to the suggestion of aggressive driving and the modifications indicating the car may be used in high-risk activities like racing.

Wheel Arches

- What is it: Enlarged arches to accommodate bigger wheels.

- How it's fitted: Wheel arches are installed around the existing wheel openings, often involving cutting or modifying the car’s bodywork to fit larger tyres.

- Underwriter view: Allowing for larger tyres can enhance the car's performance and handling but also increases the risk of aggressive driving.

- Impact on premiums: Increases by 20-25% as it allows for larger tyres, enhancing performance and increasing the perceived risk.

Custom Lights

- What is it: Unique lighting setups for aesthetic or functional purposes.

- How it's fitted: Custom lights can include aftermarket headlights, taillights, underglow kits, and other lighting accessories. These are installed by replacing or adding to the car’s existing lighting system.

- Underwriter view: Custom lights can be illegal if they do not comply with road safety regulations and can be distracting to other drivers.

- Impact on premiums: Increases by 10-15% due to potential legal issues and the possibility of distracting other drivers, increasing the risk of accidents.

Additional Security Systems

- What is it: Anti-theft systems like alarms or trackers.

- How it's fitted: Installed professionally or DIY, additional security systems can include immobilizers, alarms, GPS tracking devices, and steering wheel locks.

- Underwriter view: Reduces theft risk by making the car harder to steal or easier to recover if stolen.

- Impact on premiums: Decreases by 5-10% due to enhanced security features that lower the likelihood of theft.

Rear Spoilers

- What is it: Aerodynamic devices mounted on the rear of the car.

- How it's fitted: Rear spoilers are bolted or bonded onto the trunk or roof of the car. They are designed to improve aerodynamics by providing downforce at high speeds.

- Underwriter view: Spoilers are often associated with high-speed driving and risk-taking behaviour.

- Impact on premiums: Increases by 10-20% because of the potential for risky driving behaviour and the enhancement of the vehicle's performance characteristics.

Performance Tyres

- What is it: High-performance tyres for better handling.

- How it's fitted: Replacing standard tyres with performance versions that offer better grip and handling. This usually involves selecting tyres designed for specific driving conditions, such as racing or high-speed driving.

- Underwriter view: Suggests higher-risk driving due to improved handling and performance capabilities.

- Impact on premiums: Increases by 5-10% because performance tyres enhance the car’s ability to handle higher speeds and aggressive driving, increasing the risk.

Lowered Suspension

- What is it: Reducing the car’s ride height.

- How it's fitted: Lowering the suspension involves replacing the car’s springs with shorter ones or using adjustable coilovers to reduce the ride height. This improves handling and aesthetics.

- Underwriter view: Enhances handling but can affect safety on uneven roads and increase the likelihood of damage to the car's underside.

- Impact on premiums: Increases by 25-50% as it changes the car's handling dynamics and can lead to more aggressive driving and increased wear on the vehicle.

Custom Exhaust Tips

- What is it: Decorative tips on the exhaust pipe.

- How it's fitted: Attached to the end of the exhaust system, custom exhaust tips are primarily aesthetic but can also affect the exhaust sound slightly.

- Underwriter view: Enhances appearance and may increase noise levels, which suggests performance modifications.

- Impact on premiums: Increases by 5-10% due to the perception of performance enhancements and potential for increased noise, indicating higher-risk driving behaviour.

Sunroofs/Moonroofs

- What is it: Panels in the roof that open for ventilation and light.

- How it's fitted: Installed into the roof structure, sunroofs or moonroofs can be either fixed or retractable. This modification requires cutting into the roof and ensuring a proper seal to prevent leaks.

- Underwriter view: Adds value to the car and increases the potential for water damage and theft entry points.

- Impact on premiums: Increases by 5-10% due to the added value and the increased risk of water damage and theft.

Body Decals and Wraps

- What is it: Custom graphics or wraps for a unique appearance.

- How it's fitted: Applied to the car’s exterior, body decals and wraps are made of vinyl and can be customized with various designs and colours.

- Underwriter view: Makes the car more distinctive, increasing its attractiveness to thieves.

- Impact on premiums: Increases by 5-10% due to the higher theft risk associated with distinctive and customized appearances.

Modified Gearbox

- What is it: Changes to the transmission for better performance.

- How it's fitted: Replacing or upgrading the transmission to improve gear shifts and overall performance. This can include installing a short-throw shifter or changing gear ratios.

- Underwriter view: Enhances performance, suggesting higher-risk driving behaviour.

- Impact on premiums: Increases by 10-15% because it indicates aggressive driving and the potential for increased wear on the transmission.

Custom Steering Wheels

- What is it: Aftermarket steering wheels.

- How it's fitted: Replacing the factory steering wheel with an aftermarket one, often requiring an adapter kit to fit the new wheel to the car’s steering column.

- Underwriter view: Can affect control and suggest high-performance modifications.

- Impact on premiums: Increases by 5-10% due to potential safety issues and the association with performance driving.

LPG Conversion

- What is it: Converting the car to run on Liquefied Petroleum Gas.

- How it's fitted: Installing an LPG tank and fuel system alongside the existing petrol or diesel system, allowing the car to run on either fuel.

- Underwriter view: Seen as an eco-friendly improvement that can reduce fuel costs and emissions.

- Impact on premiums: Neutral to decrease by 5% because it can reduce running costs and emissions, making it an environmentally friendly and cost-effective modification.

Modifications FAQ

- Any alteration made to a vehicle after it has left the manufacturer.

- Includes changes to the engine, body, interior, or performance characteristics.

- Examples: adding a turbocharger, custom paint jobs, installing a new sound system, or changing the suspension.

- Yes, it's essential to keep your insurer informed of any modifications.

- Failure to declare modifications can result in your policy being voided.

- Claims may be denied if undisclosed modifications are discovered.

- Performance-enhancing mods typically increase premiums.

- Safety and security enhancements may decrease premiums.

- Aesthetic changes can also impact premiums depending on their effect on the car's value and theft risk.

- Increased speed and performance can lead to a higher likelihood of accidents.

- Enhanced performance puts additional strain on engine components, increasing maintenance costs.

- Insurers perceive these cars as being driven more aggressively.

- Yes, approved security systems can reduce your premiums.

- Security systems include alarms, immobilizers, and tracking devices.

- These systems reduce the risk of theft and can make your car less attractive to thieves.

- Custom paint jobs or body kits can increase premiums by raising the car’s value.

- These modifications make the car more attractive to thieves.

- Insurers may consider the increased cost of repairs in case of an accident.

- Not all modifications may be covered.

- Some insurers exclude specific modifications from their policies.

- It's essential to check with your provider before making any changes.

- Your insurance policy may become invalid.

- Claims could be rejected if undeclared modifications are discovered.

- You could be responsible for any repair costs or damages out-of-pocket.

- Some modifications may enhance the car’s appeal to specific buyers.

- Others could reduce its market value if they are not to the buyer's taste.

- High-performance modifications might attract enthusiasts but could deter general buyers.

- Contact your insurer to discuss any planned modifications.

- Confirm whether they will be covered and how they will impact your premium.

- Some insurers may require detailed information or inspections.

- Yes, especially those affecting the engine or electronics.

- Always check with the manufacturer before making significant changes.

- Modifications that alter the car's original specifications can void warranties.

- Yes, modifications must be declared even for third-party insurance.

- They can affect the risk profile and premium.

- Undeclared modifications can lead to claims being denied.

- Yes, some insurers specialize in policies for modified cars.

- These policies may offer more competitive rates and better coverage options.

- They understand the specific needs and risks associated with modified vehicles.

- Practical modifications like tow bars often have little to no impact.

- Minor aesthetic changes might also not affect premiums significantly.

- It varies by insurer, so it's always best to check.

- Yes, larger wheels can affect handling and performance.

- They may increase your insurance premiums.

- Ensure the wheels meet safety standards and are correctly installed.

- Lowering suspension can improve handling but also increase risk.

- It can lead to higher premiums due to the potential for aggressive driving.

- It may also increase wear and tear on the vehicle.

- Some insurers may offer discounts for modifications like LPG conversions.

- These modifications can reduce emissions and fuel costs.

- Eco-friendly modifications are seen as positive changes.

- A policy where you and the insurer agree on the car’s value at the start.

- Beneficial for heavily modified cars.

- Ensures you receive the agreed amount in case of total loss.

- It’s challenging due to the high-risk nature of these systems.

- Some insurers may refuse coverage.

- Others will significantly increase premiums due to the associated risks.

- Yes, adding a turbocharger significantly boosts performance.

- This will likely increase your premium due to higher risk.

- Turbochargers are associated with high-speed driving.

- Generally, yes, but you need to inform your insurer.

- These modifications can increase the car's value and theft risk.

- They can also affect repair costs in case of damage.

- Some insurers require professional installation.

- Ensures modifications meet safety standards.

- Professional installation can affect coverage and claims processing.

- Yes, but you must disclose all modifications to the new insurer.

- Modifications may affect your premium with the new provider.

- Compare policies to ensure you get the best coverage for your modified vehicle.

- Engine swaps significantly alter the vehicle’s performance.

- Usually result in higher premiums and require detailed disclosure.

- Insurers view them as high-risk due to the changes in the car's dynamics.

- Yes, some insurers offer temporary or short-term policies.

- Useful for events or test driving.

- Ensure all modifications are declared for accurate coverage.

- Receipts for modifications and installation proof.

- Sometimes an independent valuation is required.

- Detailed descriptions and photos of modifications can be helpful.

- Modifications do not directly affect no-claims bonuses.

- However, failing to declare them can invalidate your policy.

- An invalid policy can affect your no-claims status.

- Indicates the car may be used for high-risk activities like racing.

- Can increase premiums due to perceived aggressive driving.

- Enhances safety in rollovers but also suggests higher-risk usage.

- Typically, yes, because modifications increase the car’s value and risk.

- Performance and aesthetic changes can lead to higher premiums.

- Insurers factor in the cost of repairs and the increased likelihood of claims.

- It depends on the insurer and the type of modification.

- Homemade modifications may be harder to insure due to unknown quality.

- Professional inspections may be required to ensure safety standards are met.