Depending on the insurer, the postcode where you live is the fourth most significant factor affecting the price of your insurance. There are around 1.8 million individual postcodes in the UK and underwriters can rate down to the full postcode level if they wish. However, most companies generally keep their rating to the district level e.g. RH10.

Postcode rating

Insurance underwriters can garner a lot of information from your postcode. They can use various databases including their own statistical information to make a decision of how much of a risk your postcode is.

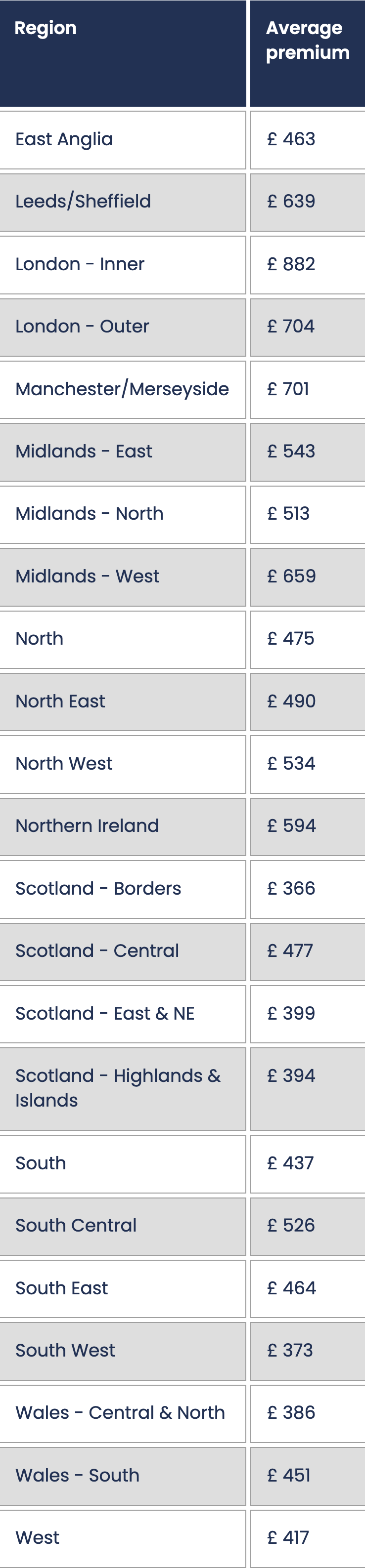

Average cost by location:

(Source: Car Insurance Price Index from Confused)

Crime rate

This is probably the most important aspect of the postcode risk assessment. Insurers are specifically concerned about the number of cars stolen or broken into for each postcode based on recorded police data. If the crime rate for a particular area is extremely bad then some insurers may not even offer a quote.

Inner city postcodes

Historically speaking, the term inner city generally referred to low-income housing and rundown neighbourhoods in and around a city location. However, modern living now means that many people of all income levels now reside in city centres with large numbers living in high rise apartment blocks.

Living in a city postcode maybe perceived by insurers as a higher risk due to the high volume of traffic. Increased traffic may mean a higher rate of accidents, bumps and knocks to your car. The inner city postcodes can also often include high crime areas so you get a double whammy on your rate.

It should be noted however that many insurers may choose to re-rate certain inner city postcodes to take into account the redevelopment of an area. This can result in previous high risk rated areas now getting a more favourable rate.

Suburban postcodes

Suburban postcodes differ vastly across the country and can be hard to rate. Some suburbs are very nice, the houses and garages have alarm systems, CCTV and neighbourhood watch etc. that deter criminals and keep the crime rate very low. However, other suburbs have very high crime rates, particularly vehicle crime which will inevitably attract higher insurance rates.

New housing estates can be particularly difficult for underwriters to rate due to the lack of available data and historical claims statistics. In such cases many insurers may make assumptions based on areas close by. This has become more of a problem in recent times where modern, expensive housing is now being built in areas that have traditionally been rated as high risk. It may take many years for insurers to build claims data and properly rate these areas.

Rural postcodes

Rural postcodes are often the cheapest areas to insure. They have low traffic and crime is often very low - all good signs for insurers. However, some rural areas are very distant from the cities and the amount you save on your good postcode area could be negated by the fact you have to travel longer distances to commute to work and as such have higher mileage.

Historical insurance data

Many insurers, particularly the big ones, have vast amounts of historical claims data from every postcode. This gives the underwriter a real-world view of how risky a particular postcode is based on actual claims made over a number of years.

However, this data doesn't always take into account that some areas change, are rejuvenated and receive investment that makes them a more desirable and safer place to live - it may take some time for certain underwriters to catch up and review an area for risk.

Moving house

Many people are shocked when they find their car insurance premium has skyrocketed after moving house or perhaps has nosedived and become much cheaper. It's because the postcode has changed and as such, so has the risk profile.

It's always worth getting insurance quotes for your car and home insurance based on your new postcode before you make the leap to move. This is particularly important if you need to budget carefully month to month. A house in a less desirable area may be cheaper in terms of your monthly mortgage payments but the increased costs of your insurance could wipe those savings out.